3 Essential Documents in your Estate Plan

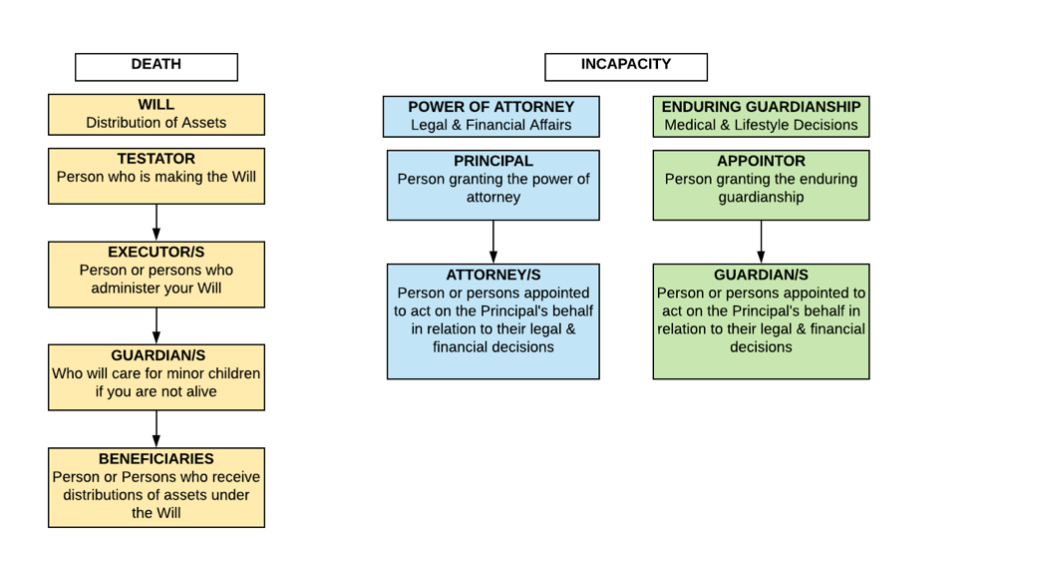

A basic estate plan should have 3 essential documents including a Will, Power of Attorney and Enduring Guardianship. As you can see from the diagram below, a Will covers your assets in the event of your death whereas the Power of Attorney and Enduring Guardianship cover your affairs in the event of your incapacity. All three documents are equally as important given they cover off on different scenarios. More information on each document is outlined below.

Will (distribution of assets upon death)

A Will is a legal document by which a person, the testator, expresses his or her wishes as to how their assets are to be distributed after their death.

A Will names one or more persons to manage your estate until all the assets are distributed (this is the executor). It also nominates who you would like to receive a gift or benefit from your estate (the beneficiaries). This ensures your assets pass to the beneficiaries of your choosing upon your death.

A Will may also name one or more persons to care for and make decisions in relation to your children in the event of your death (this is the guardian). This is an important appointment as it allows you to legally appoint someone to look after your minor children.

If you do not have a Will, upon your passing an interested person (usually a close family member or friend) can apply to become the administrator of your estate. This process is often time consuming and strenuous on your family/friends during a time of grief. Therefore, having a Will prepared during your lifetime will greatly benefit your family/friends.

Power of Attorney (Legal & Financial decisions)

An Attorney deals with the legal and financial affairs on behalf of the person that grants the Power of Attorney (the Principal). An Enduring Power of Attorney will continue to be effective even after you lose capacity.

The Principal can elect to have the Attorney act immediately (i.e. before they lose capacity) or only once a medical practitioner considers they are unable to manage their own affairs.

This is an important document to have in place as without it no one is able to manage your money and assets on your behalf if you lose capacity.

If you do not have a Power of Attorney in place and you lose capacity, a close relative or friend may apply to the Guardianship Tribunal to become your financial manager. This process is costly and time consuming and can be avoided by simply putting in place a Power of Attorney while you are mentally capable.

Enduring Guardianship (Medical & Lifestyle decisions)

An Enduring Guardian deals with the medical and lifestyle affairs on behalf of the person that grants the Enduring Guardian (the Principal), once that person becomes partially or totally incapable of managing their own affairs. This includes where they live, heath care that they receive, dealing with doctors etc. This power will only operate if you become partially or totally incapacitated.

This is an important document to have in place as without it no one is able to make medical and lifestyle decisions on your behalf if you lose capacity.

If you do not have an Enduring Guardianship in place and you lose capacity, a close relative or friend may apply to the Guardianship Tribunal to become your guardian. This is a similar process to an application for financial manager as discussed above. As such the time and costs of this process can be avoided by simply putting in place an Enduring Guardianship while you are mentally capable.

At Southern Waters we aim to simplify these documents for you so you can easily understand the contents and importance of each document.

We encourage you to contact our office if you are interested in putting in place these documents or wish to discuss further.

Leave a Reply

Want to join the discussion?Feel free to contribute!